Why crowded Hong Kong may become a data center hotspot

HONG KONG -- The idea of data centers may conjure the image of a sprawling, squat row of nondescript buildings somewhere on pastoral U.S. land. Space is important, and proximity less so -- there is no obvious reason to plop a data center in the middle of the city.

Yet the Hong Kong government is pushing for the crowded metropolis to become a hub for data centers serving the region, describing it as a race against rivals like Singapore and Malaysia. Proponents say the city is an ideal place for this industry, and it is hard to argue against their logic.

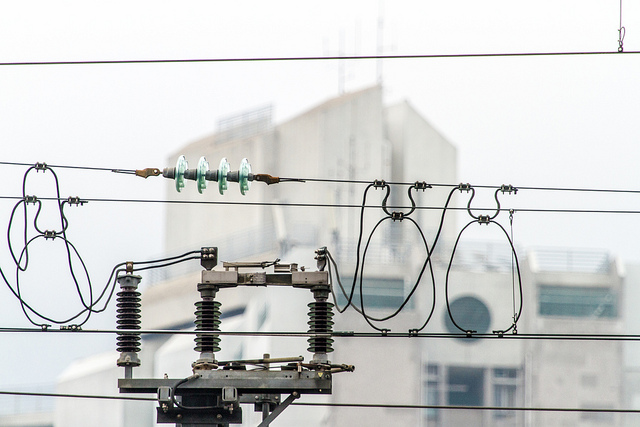

The government points out that there is demand for data centers by the city's thriving financial and logistics sectors. It also stresses that the city is not prone to earthquakes or tornadoes, and it has an unusually reliable electrical grid, because of the way the duopoly power providers can back up one another.

But its advantageous location, as the gateway into China, coupled with a unique position of political freedom makes the city really stand out as a spot to host data, says Charles Mok, a lawmaker and entrepreneur who advocates for the development of a strong information technology sector here.

“One big reason for many of these data centers to be placed here -- even including many of the Mainland telecom companies, like China Telecom, China Unicom, and so on, they are building very big data centers in Hong Kong -- is because they want to be outside of the China firewall, while being able to be close enough that they can still serve China,” he said.

In the past few years, the government has announced incentives for companies to convert old warehouses into data storage facilities as well as to build ones from scratch. The push is part of a broader goal to grow an information technology industry here, one that critics say has not taken off as quickly as it could have.

Mok says the economy of Hong Kong, often ranked freest in the world, means an open telecommunications infrastructure in which any company can easily acquire a license to become a telecom operator, a requirement for offering data center and other Internet services.

“Imagine the trouble they have to go through and the prohibited zones they cannot operate in in China. That does not exist in Hong Kong. As long as they’re willing to invest, they can come here and get licensed and do almost anything they want,” he said.

While growing any industry creates jobs, the appeal of drawing data centers to the city is their permanence, Mok said. Whereas offices or shops might close or relocate every few years, data storage cannot be easily uprooted.

“In terms of capital investment this is one of the very rare areas where companies are willing to spend hundreds of millions of dollars or more in Hong Kong to build long-term infrastructure investment for a long period of time,” Mok said.

Ganesan Periakarruppan, a Kuala Lumpur-based analyst at Frost & Sullivan, a market research firm, says Singapore, Australia and Hong Kong are the strongest markets to grow data center industries in the Asia Pacific region because, in addition to not being prone to natural disasters, they have a strong English-speaking pool of I.T. workers.

Ganesan says that the greatest challenge in Asia is to be able to maintain Tier 4 data centers, the highest level, which specifies electrical power and cooling requirements, which can scarcely be met anywhere in Asia save for Hong Kong and Singapore. “As long as you’ve got continuous power, there are no other challenges,” he says.

Land is one of the most contentious issues surrounding the topic, as property here is scarce and expensive, while data centers require large buildings. But experts agree that the cost of space will not be a hindrance. Other than government incentives, which include temporary fee exemptions and discounts on land leases, companies have no better alternative.

“In places like China, Malaysia, of course you have a lot of real estate,” Ganesan said. “But if you look at places like Hong Kong and Singapore, there’s a lot of demand, so there’s no other option but to put it in the center of town.”

Photo: Flickr/See-ming Lee

This post was originally published on Smartplanet.com