Is the student loan debt "bubble" bursting?

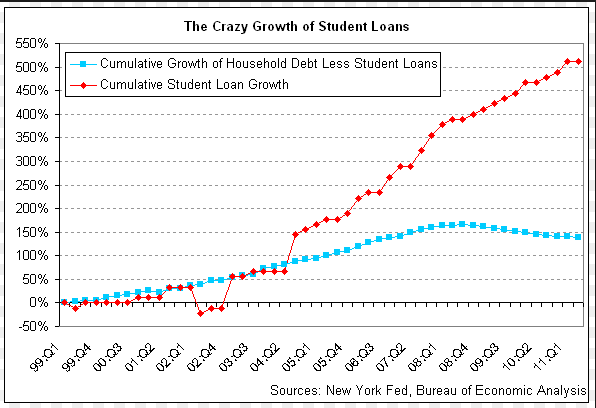

Student loan defaults in the United States are now at a record high and recent graduates are on average accumulating more debt than ever and the collective debt burden has doubled just within the past five years.

Today, Bloomberg's John Hechinger reported that 11 percent of recent graduates are seriously delinquent on their student loans. That figure was almost 50 percent lower in 2003. 30 percent of 20- to 24-year-olds are unemployed or not in school, Hechinger wrote. New graduates face a greater than 7 percent unemployment rate.

Tuition cost has consistently risen faster than the consumer price index, food and medical inflation since 1978. There has been an especially dramatic increase over the past several years as states slashed their higher education budgets. Overall enrollment has declined since 2010, the National Student Clearinghouse reports.

Students that do enroll are leaving their undergraduate studies with an average of US$30,000 in loan debt, according to data from Fidelity. That figure was closer to $15,000 a decade ago. There is now a total of $986 billion of outstanding student loan debt in the U.S. -- twice as much as in 2009. It's being called a new "bubble," and that has compelled Washington to act.

Democratic Senator Elizabeth Warren recently asked why students are paying more for money than banks and proposed legislation that would temporarily lower borrowing rates to .75 percent for one year. The U.S. House of Representatives today passed a bill (it does that now and again) that would tie federal student loan rates to 10-year U.S. Treasury bond yields.

Either proposal would provide welcome relief. However, the bond yield rate could rise over time as evidenced by a 1% jump in Japan's 10-year yield just yesterday. The House did place an 8.5 percent cap on the loan rate for the long haul, but that is much higher than the prime rate -- which banks pay and Warren advocates for students -- has ever been with the exception of a brief period during 1970's stagflation. Money is "cheap" now, but many graduates who have federal loans are paying around 6 percent. The House proposal would add 2.5 percent on top of the bond yield, so students would pay 4.5 percent under that plan.

The House bill is being pitched as a permanent "fix" to a legislative issues that would raise rates to 6.5 percent next year. This of course does nothing about the rates of private loans, which many graduates have as well.

It would be beneficial if students were paying a more affordable rate, especially considering that entry-level jobs are paying low wages and the debt burden is increasing. Clearly, the cost of education needs to be addressed, which is something that President Obama had suggested in his last State of the Union Address.

Maybe the political parties will find some common ground on this one before there's a major economic impact.

(image credits: The Atlantic, http://masteradmissions.com)

Related on SmartPlanet:

For more information on the cost of tuition see this infographic that was produced by CourseSmart, an e-textbook provider (e-book folks say that they are helping to cut education costs).

This post was originally published on Smartplanet.com